In the realm of property investment, the allure of securing the perfect asset can sometimes lead to a common and costly pitfall: overcapitalisation. Overcapitalisation occurs when the amount invested in a property significantly exceeds its market value, potentially leading to losses rather than the anticipated gains. At CapEx Properties, we champion the values of respect, honesty, integrity, and transparency. Guided by these principles, we aim to empower our clients with the knowledge and strategies needed to avoid the trap of overcapitalising, ensuring a profitable and wise investment. Here are expert insights and practical advice to navigate this complex aspect of property investment.

Understanding Overcapitalisation

Overcapitalisation doesn't only stem from purchasing a property at an inflated price; it can also occur through excessive renovations or upgrades that do not proportionately increase the property's value. It's a scenario where the cost of acquiring and improving a property outweighs the price you can realistically sell or rent it for in the current market.

Why It's a Concern

The implications of overcapitalising are far-reaching. It can affect your return on investment (ROI), reduce your property's liquidity, and increase the time it takes to recoup your investment. In a fluctuating market, the risk of ending up with a property that's difficult to sell or rent at a profitable rate is a reality that investors must be wary of.

Tips to Avoid Overcapitalising

- Thorough Market Research

Before any investment, comprehensive research is paramount. Understand the local property market, including average property prices, rental yields, and long-term trends. Tools and data provided by CapEx Properties can offer invaluable insights, helping you make informed decisions based on current market conditions.

- Professional Valuation

Always seek professional valuation services before purchasing or undertaking major renovations. This step cannot be overstated; it provides a safeguard against investing more into a property than what it's worth in the eyes of the market.

- Budgeting with Precision

Set a clear budget for both acquisition and any planned improvements, including a buffer for unexpected expenses. Stick to this budget religiously. Overcapitalisation often results from escalating renovation costs that were not accurately forecasted.

- Focus on Value-Adding Improvements

Not all upgrades increase a property's value. Focus on renovations that are known to boost appeal and value, such as kitchen and bathroom updates, adding energy-efficient features, or creating additional living space. Consult with CapEx Properties to identify which improvements are most likely to enhance your property's market value.

- Consider the Ceiling Price

Every neighbourhood has a ceiling price – the maximum value properties in the area tend to sell for. Ensure your total investment does not exceed this figure. Investing beyond the ceiling price greatly increases the risk of overcapitalisation, as the local market is unlikely to support a higher valuation.

- Plan for the Long Term

Property investment should always be approached with a long-term perspective. Short-term market fluctuations can affect property values, so your strategy should be robust enough to withstand these changes without leading to overcapitalisation.

Real-Life Example

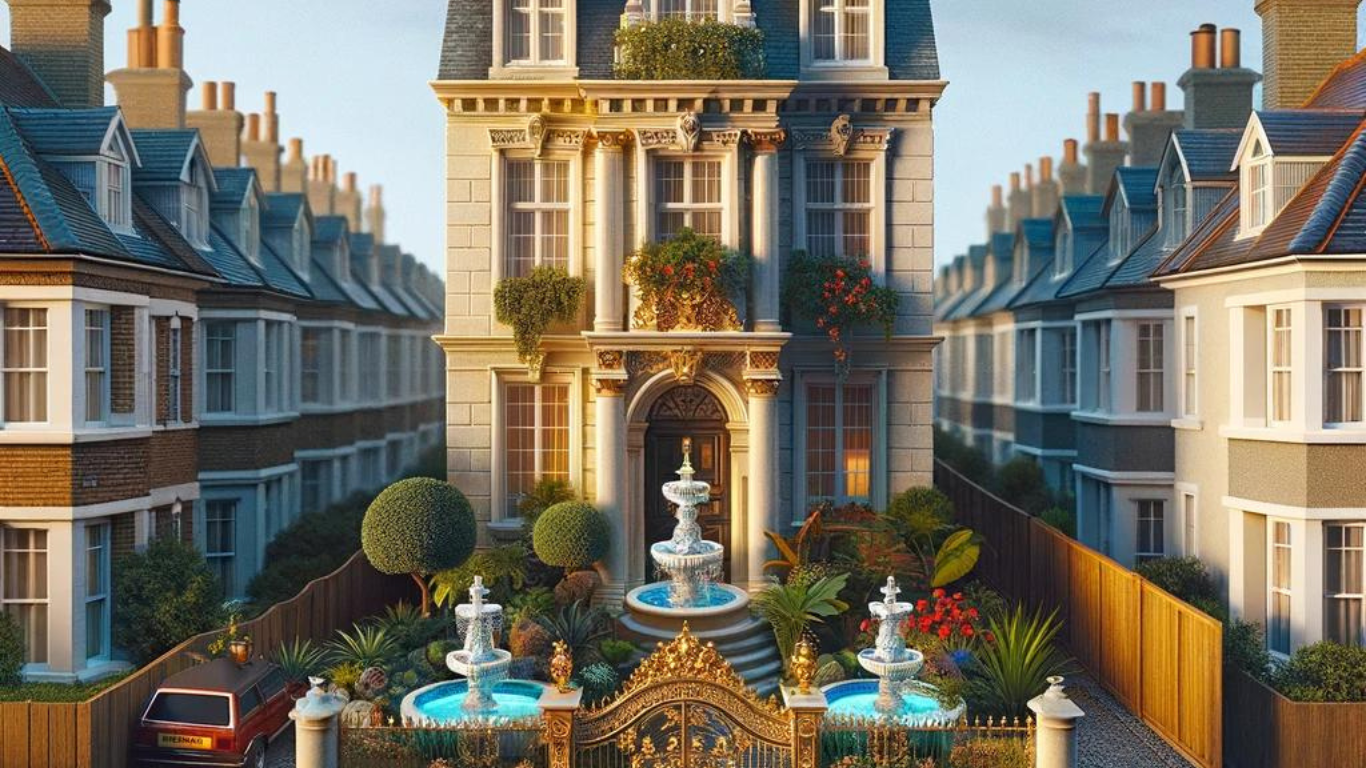

Consider the case of an investor who purchased a residential property in a promising London suburb. Driven by enthusiasm, they immediately embarked on extensive renovations, aiming to transform it into one of the most luxurious homes in the area. Despite the high-quality upgrades, when it came time to sell, the property lingered on the market, with offers falling short of the total investment. This scenario underscores the importance of understanding market dynamics and the risks of overcapitalising. Through careful planning and adherence to market research, such pitfalls can be avoided.

Why CapEx Properties?

CapEx Properties is not just about finding you the right investment; it's about forging a path to success through informed decisions and strategic planning. Our approach is tailored to prevent overcapitalisation, ensuring that every investment maximises its potential for profit. We provide our clients with up-to-date market insights, professional valuations, and strategic advice tailored to the nuances of the UK property market.

Investing in property carries its risks, but with CapEx Properties, you're equipped to navigate these challenges effectively. Our commitment to honesty, integrity, and transparency means you're always informed about the realities of your investment, helping you make decisions that align with your financial goals.

In conclusion, overcapitalisation is a significant risk in UK property investment, but with the right strategies and expert guidance, it can be avoided. By partnering with CapEx Properties, you gain access to a wealth of knowledge and experience, ensuring your investment journey is both profitable and aligned with the highest standards of integrity and professionalism. Together, we can achieve exceptional results, rooted in a profound understanding of the property market and a commitment to your success.